Acquisition

Objective: Gain an understanding of how to create an Acquisition record for Fair Value or Historical Value.

Prerequisites: This action requires some things to be completed prior to commencing. Asset Record must exist in the database. Component Record must exist in the database.

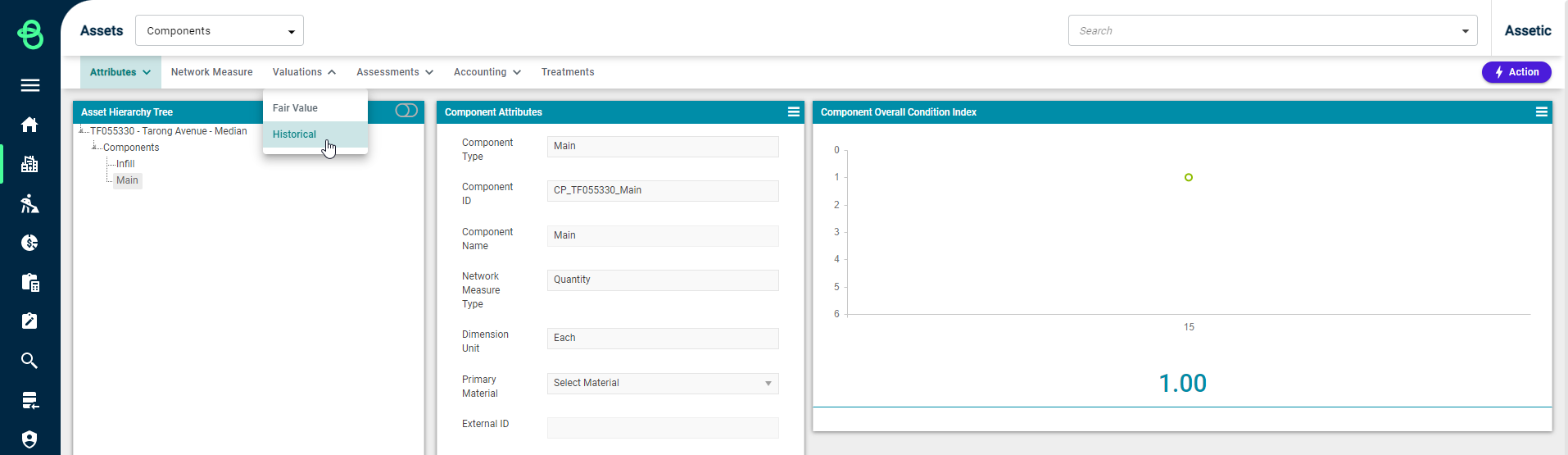

When viewing a component, a user can perform an 'Acquisition' by first selecting either Historical Value or Fair Value from the Valuations drop-down menu.

Selecting 'Historical' displays an overview of all Historical Valuations for the component.

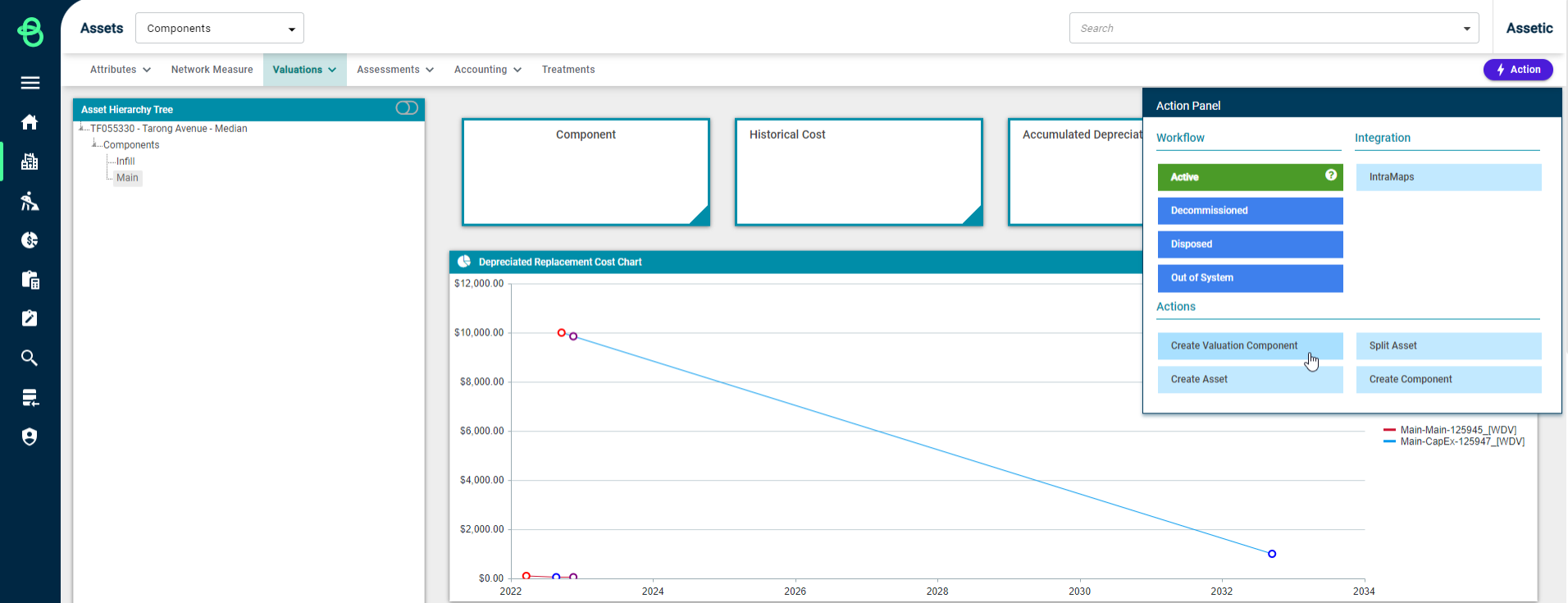

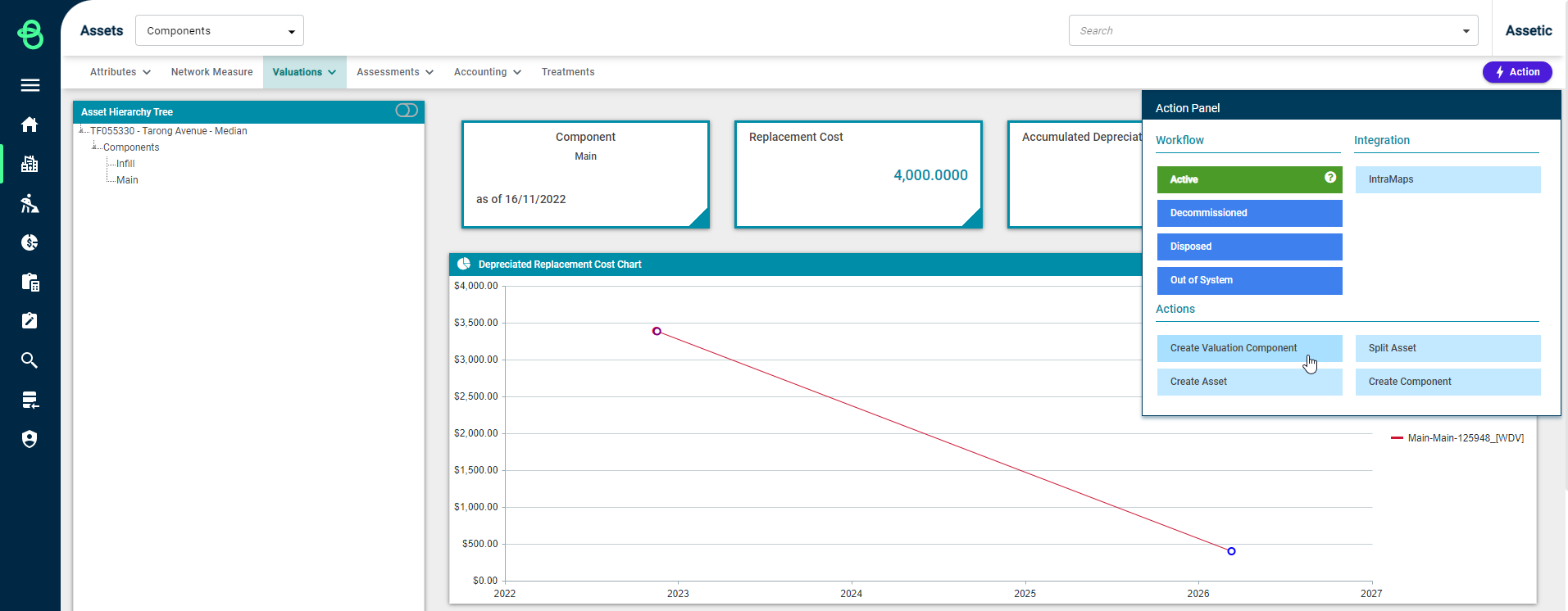

To create an Acquisition valuation record in the Historical Valuations overview, select 'Create Valuation Component' via the Action Panel.

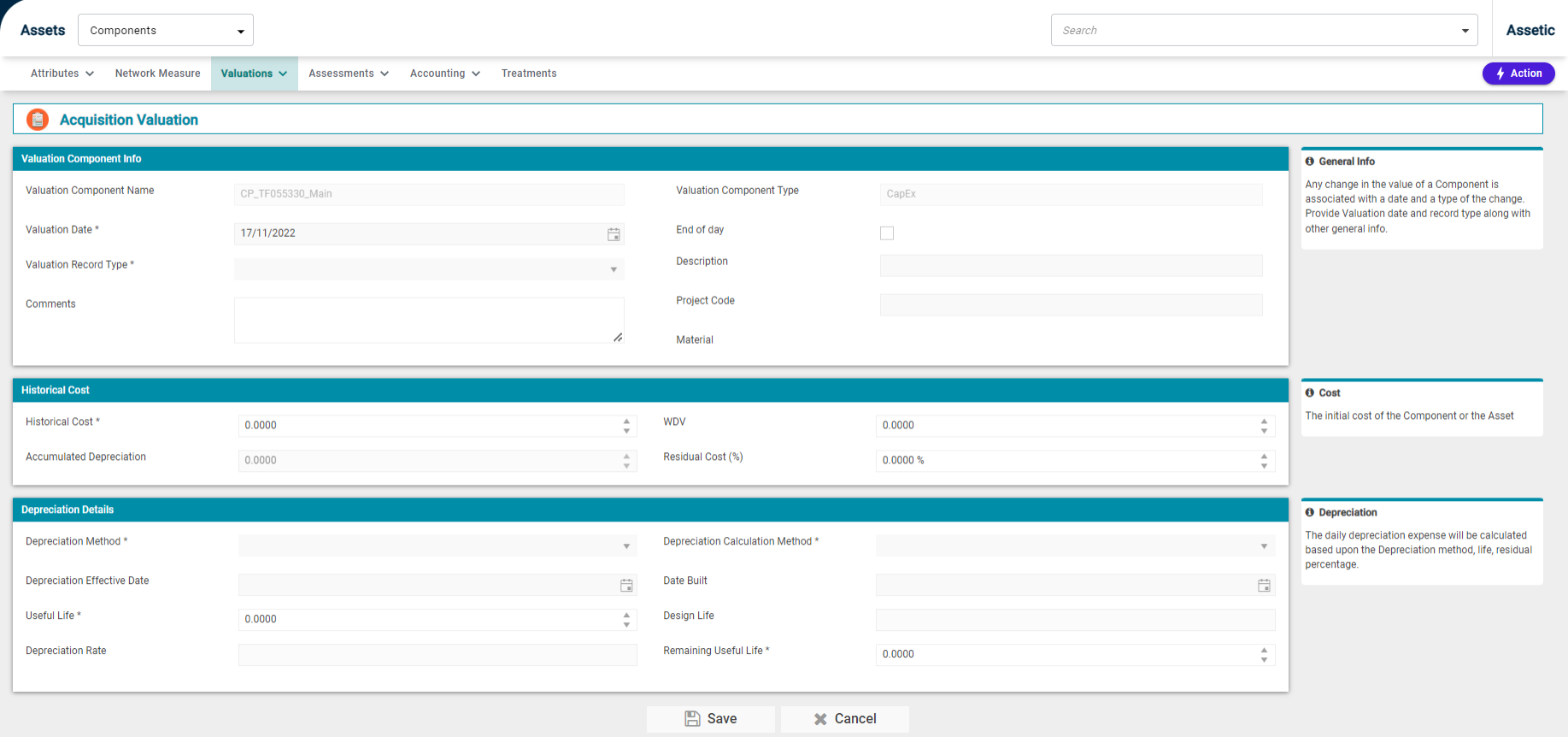

This produces the following view:

Selecting 'Fair Value' displays an overview of all Fair Valuations for the component.

To create an Acquisition valuation record in the Fair Valuations overview, select 'Create Valuation Component' via the Action Panel.

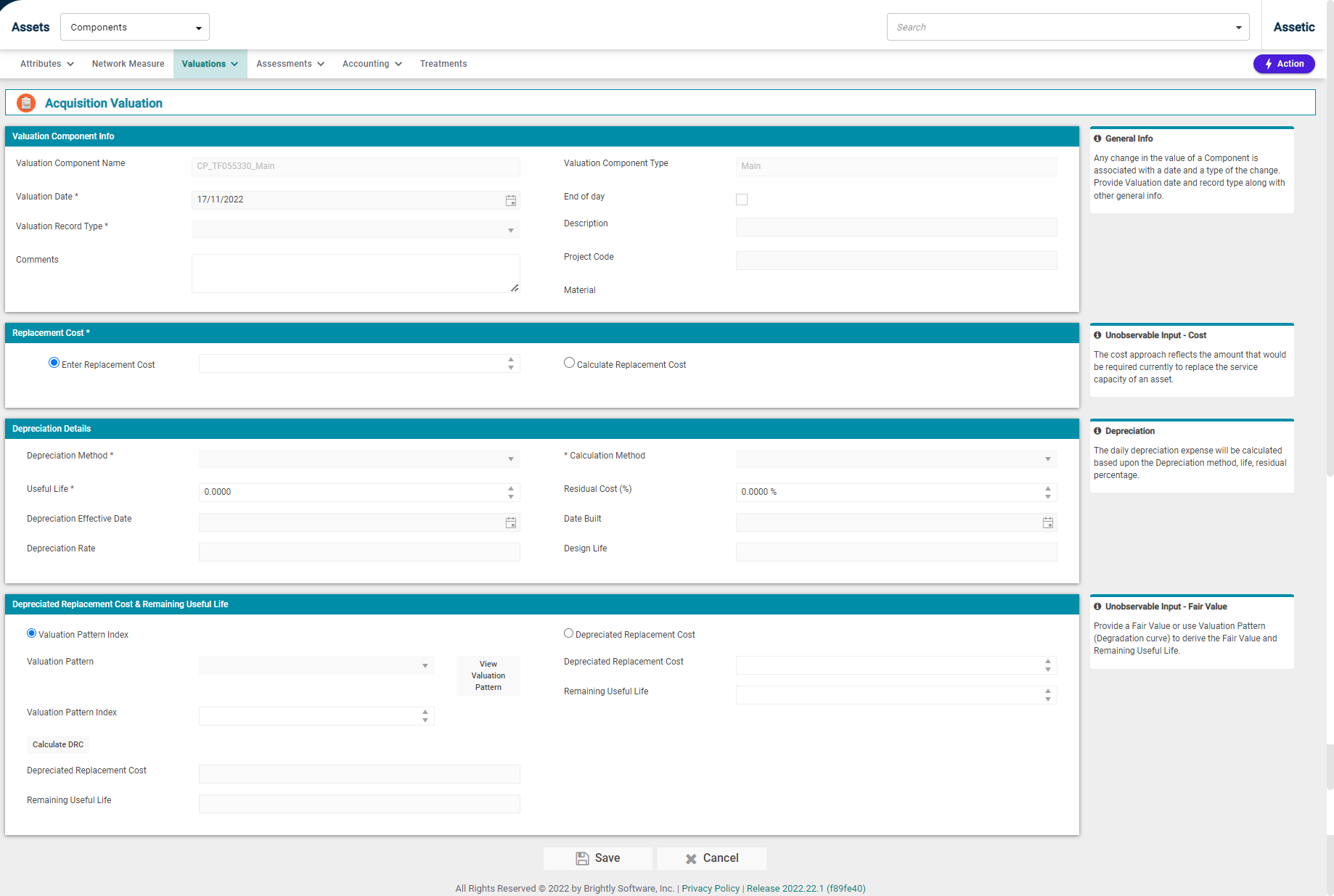

This produces the following view:

This provides a total view of what is required for an acquisition to be applied to a component.

-

Valuation Component Info:

-

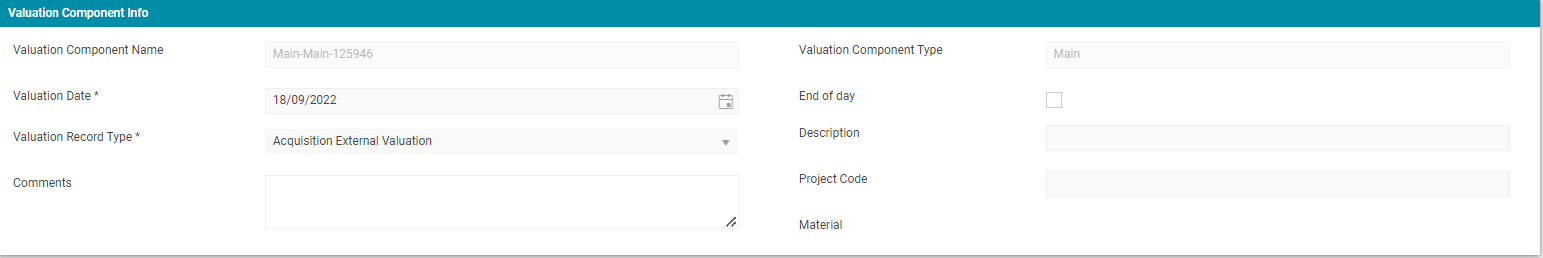

Valuation Component Name: This is not user-configurable and is populated from the parent component reference.

-

Valuation Date*: A mandatory field that is pre-filled with the current date.

-

Valuation Record Type*: This is a mandatory field which allows the user to select a valuation record subtype under Acquisition. For a 'Main' valuation component, the available record subtypes are: Purchase, Opening Value, Found Current Period, Found Prior Period, Gifted, Constructed. For a 'Capex' valuation record, the available record subtypes are: Purchase, Opening Value, Constructed.

-

Comments: A free-text box for any additional information.

-

Valuation Component Type: This is not user-configurable and is auto-populated from the parent component record. On a component with no valuation component records, the first acquisition will always be Main, and all subsequent entries will be Capex.

-

End of day: This checkbox indicates when the valuation is measured from. If checked, the valuation will be measured from the start of the next day.

-

Description: A free-text field where the description can be stored.

-

Project Code: This can be used to allocate the valuation to a specific project.

-

Material: This field is with the Material from the Parent Component, and cannot be directly modified at the Valuation level.

NOTE The first record created is a Main acquisition and all the subsequent records are Capex. A user can create multiple Valuation Components for a physical Component.

-

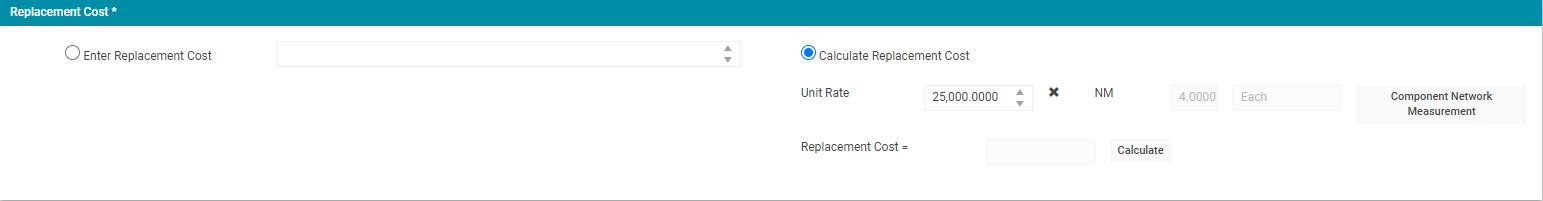

Replacement Cost:

-

Enter Replacement Cost: This field uses a numeric value, as shown above:

-

Calculate Replacement Cost: This allows the Replacement Cost to be calculated by the system, as shown above:

NOTE Replacement Cost requires only one of the two available options.

-

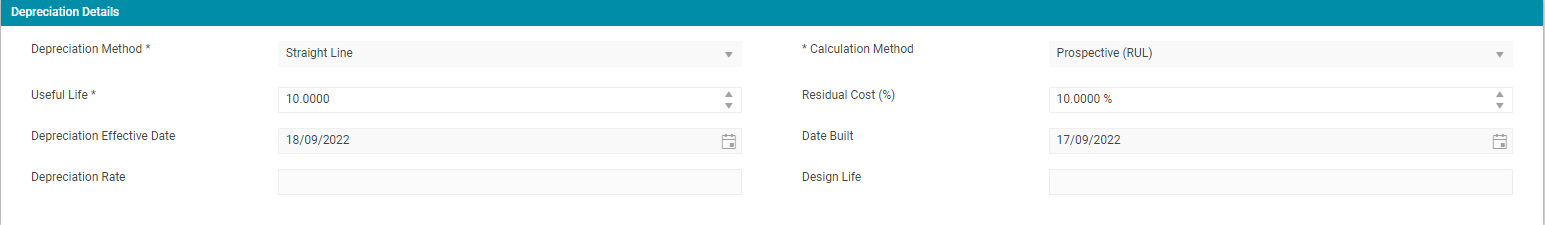

Depreciation Details:

-

Depreciation Method: A mandatory drop-down field from which a Depreciation Method must be selected.

-

Useful Life: Useful Life is a mandatory field.

-

Depreciation Effective Date: Depreciation Effective Date is the beginning date from which depreciation is calculated.

-

Depreciation Rate: Depreciation Rate is not editable and is system calculated based on the previous inputs.

Depreciation Calculation Method: A mandatory field that contains the following options:

-

Prospective (RUL) - that is a forward-looking approach to calculating the depreciated replacement cost.

-

Retrospective (UL) - this approach is used to calculate depreciated replacement cost if the initial asset value requires updating that will affect the depreciated value.

-

Retrospective (Estimated UL) - that is backward-looking with an estimated approach to calculating depreciated replacement cost.

-

Residual Cost: A drop-down field to select a residual cost value (in %).

-

Date Built: The date when the asset was constructed.

-

Design Life: Design life is not editable and is system calculated based on the previous inputs.

-

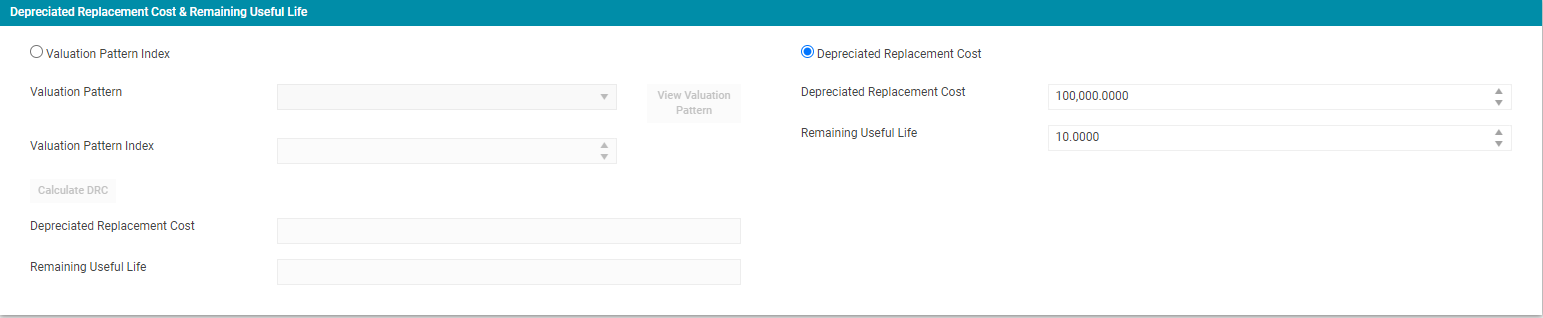

Depreciation Replacement Value & Remaining Useful Life:

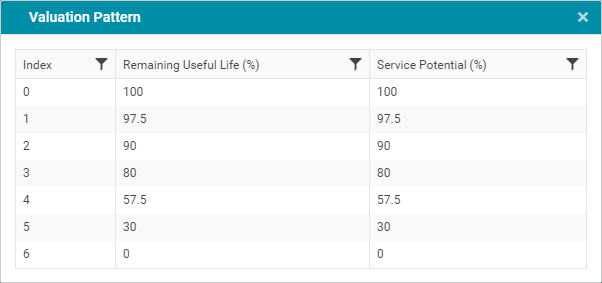

Valuation Pattern Index: Valuation Pattern is used to generate the Depreciated Replacement Value (DRV) from the available information on pattern and condition index. Select the Valuation Pattern Index radio button, then select the appropriate curve from the Valuation Pattern drop-down. By selecting the ‘View Valuation Pattern’ button, the following will be displayed:

-

Depreciated Replacement Cost: The Depreciated Replacement Cost is used when the asset has been independently valued and there is available data for the Valuation Pattern (life cycle curve) and the Index (condition). Click the ’Calculate DRC’ button and the system will generate the Depreciated Replacement Value (DRV) - in other words, what the asset is worth today - and the ‘Remaining Useful Life.’

Select the Depreciated Replacement Cost radio button, and populate the Depreciation Replacement Value cell with current data.

Once all the mandatory fields are populated, select 'Save'.

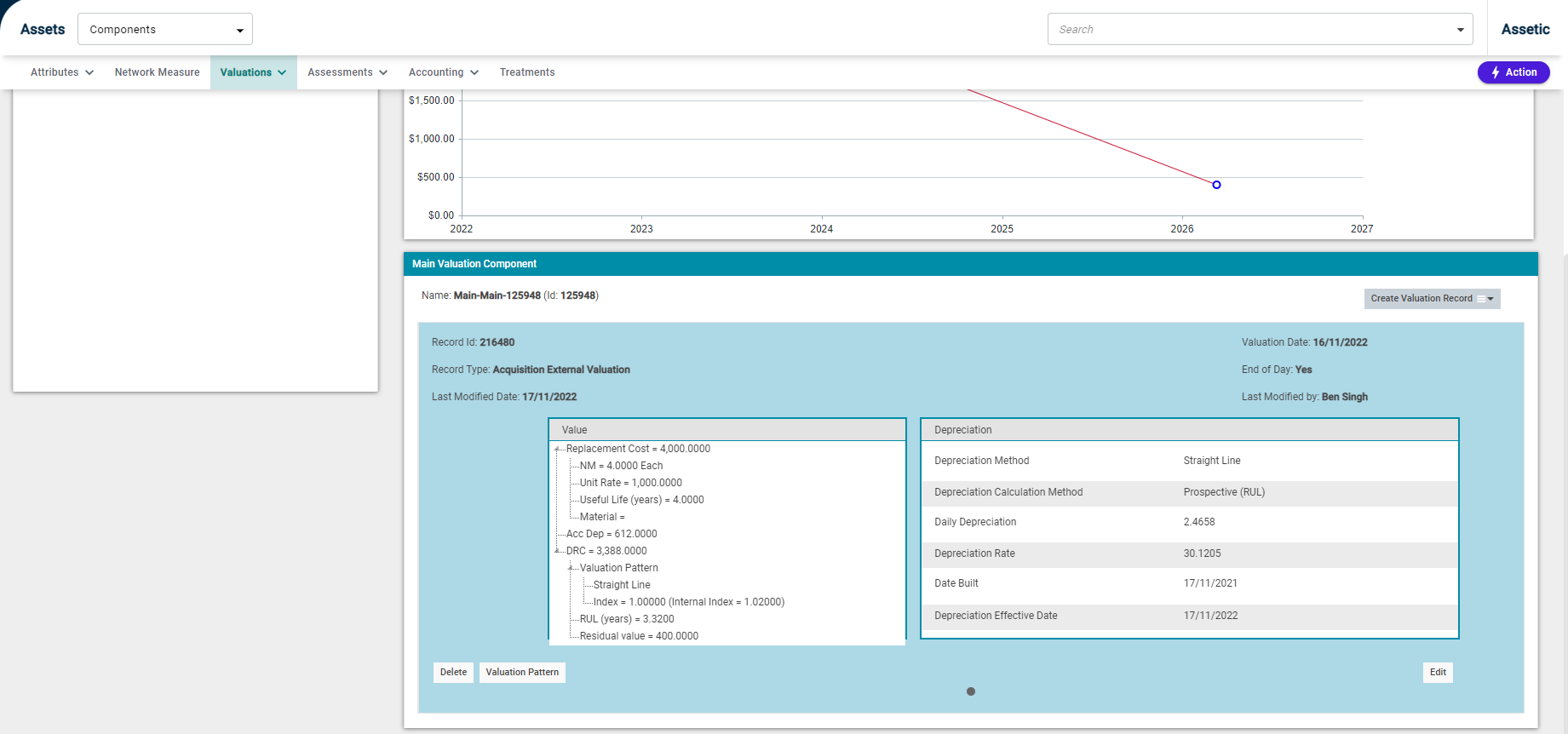

Once the valuation component has been saved it will appear in the Main Valuation Component overview window as shown below: